Prospects and Challenges for South Asian Countries Under the Pandemic

Prospects and Challenges for South Asian Countries Under the Pandemic(Yicai Global) Sept. 17 -- Since the beginning of 2020, the Coronavirus (COVID-19) has been spreading around the world, hitting hard the South Asia, which is the home to one quarter of the global population and the world’s poor and experiencing the highest population density. Since early July, infection rate across major economies of South Asia grew substantially, second to the Americas. This region faces mounting pressures on pandemic prevention and control, social assistance, and needs a large stimulus for economic recovery. This paper aims to summarize the impacts of the Coronavirus pandemic to South Asian countries and their measures to fight the pandemic and analyze the prospects of economic development in this region.

1. High Systemic Risks Impeding Efforts to Contain Pandemic

The Covid-19 global pandemic has hit all continents and countries, albeit with varying intensity. This round of the global pandemic is unique for its unprecedented complexity, infectiousness and transmission. It is hard to predict its duration and intensity, and the crisis has spilled over from the health to the social sector, economic and finance, enhancing risks of food security in a belt suffering from hunger and malnutrition resulting in aggravating distress and people’s health and lives.

Eight countries in South Asia (Afghanistan, Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan, and Sri Lanka) face high systemic risks of even a larger-scale breakout of the pandemic, in the absence of an effective containment, based on three reasons. Firstly, this region has a large population and high population density. Contagion risk is high among concentrated slum dwellers and migrants. Secondly, the testing rate has been low. The demand for testing kits far exceeds the requirements of a large population and is ill affordable. The provision of free testing is well above the countries’ capacities and resources. Third, the health infrastructure facilities and management are weak and overstretched as all countries in this region have a low number of beds per capita and rank low on the Global Health Index.

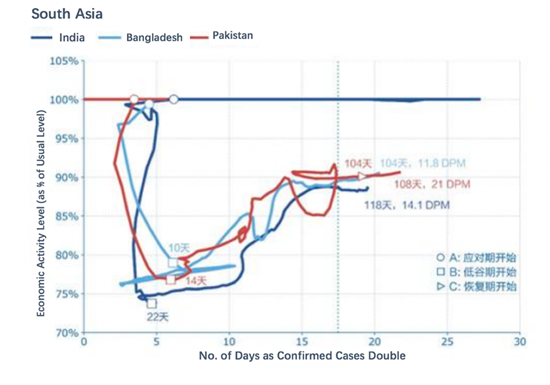

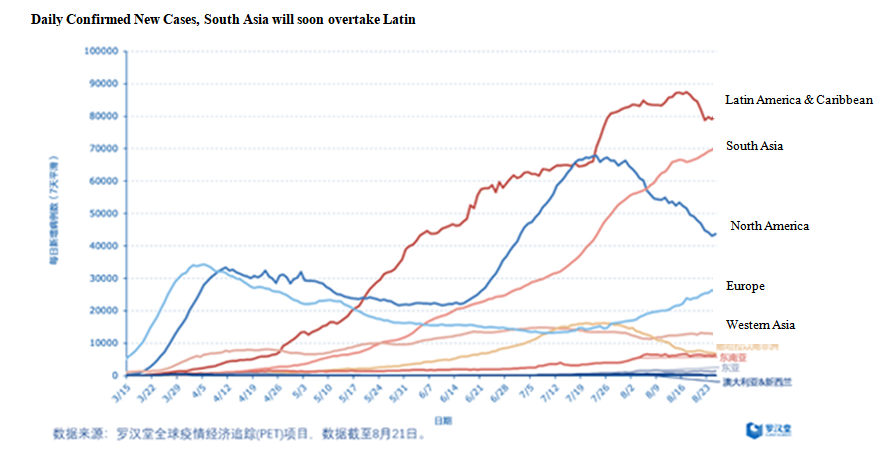

According to the recent PET data from the Luohan Academy, as shown in Figures 1 and 2, three South Asian Countries – India, Pakistan, and Bangladesh rank among the top 20 in Covid-19 affected cases. For these three countries, there are 500-1000 affected cases per 1 million population. On the one hand, this echoes the fact that the testing rate (which is 5000-7400 per million population) in this region is much lower than the other top 20 countries. On the other hand, there is still a high risk of growing cases in these countries. Large South Asian countries share a very similar pattern in their Pandemic Economy trends. As the number of affected cases will double in around 20 days, it can be predicted that the pandemic in this area will continue to worsen. As of 26 August, the number of new daily diagnoses in South Asia is already approaching that of Latin America. Nearly 100,000 cases of Covid-19 infections have been reported daily in India over the past few days, as recalled by New Delhi Television (NDTV). As of 7 September, India had overtaken Brazil as the country with the second highest number of Covid-19 infections in the world.

Figure 1. Pandemic Economy Tracker (PET), Luohan Academy

Figure 2. No. of Confirmed New Cases, Luohan Academy

2. Multiple Vulnerabilities: Regional Tensions, Demographic Challenges, Food Security, Political Fragilities, and Economic Vulnerabilities

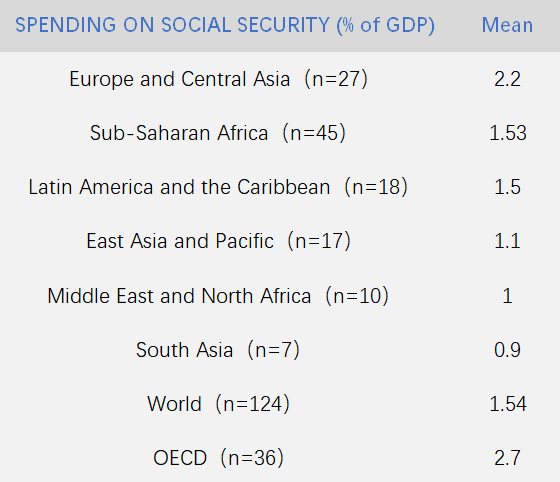

South Asia is the home to 1.89 billion people (and expected to rise to 2.1 billion by 2030), about one-fourth of the world’s population, and contributes to more than 15% of the global growth, reflecting the contribution of India given its economic size. Informality is pervasive, be it across economic structures or workforce. On a positive note, this region has a high potential for growth and productivity, but this has not been harnessed. However, this region has geographical constraints and pervasive disparities marked by high population density. A high population density renders disease prevention difficult. Relative to other regions, South Asian countries have weak social safety nets, and this is not only reflected institutionally, but also reflected in their mean spending as a proportion of GDP (see Figure 3).

Figure 3. Data source: IMF Monitor, April 2020

Food security is a key concern in the South Asia region. 35% of the world’s 800 million hungry people live in South Asia. On the Global Hunger Index, all South Asian countries rank between Low and Serious. Although the agriculture potential of the region is good, there are still mounting food security challenges due to low crop yields, population pressures, consumption practices yields, and risk of pesticide and more recent locust swarm spread. Given the high food insecurity and widespread malnutrition among children, the Covid-19 pandemic may reverse the recent positive trends in poverty reduction[1], with catastrophic and far-reaching consequences.

Political fragilities in this region are worrisome. The intra-regional conflicts have further complicated the pandemic control in this region, including Afghanistan-Taliban security challenges, the India-Pakistan cross-border violations and disputes over Kashmir, the issue of the Rohingya Refugees, etc.

The lockdowns, closures of business and retail sectors, social distancing etc. in this region have caused supply disruptions along with penetrating demand shocks as businesses, service sector and people have lost revenues and income. BOP position of South Asian Countries came under renewed pressure as most countries registered a fall in foreign inflows, exports, remittances (accounting for 30% of GDP in Nepal) and tourism receipts (accounting for two-thirds of GDP in the Maldives). Economic disruptions particularly hit Micro, Small and Medium Enterprises (MSMEs), which accounts for 30% of GDP, exports and job generation. Given 60-80% informality in South Asia, the livelihood of a large segment of workers was impacted. Opportunity costs of discontinuity of educational institutions etc. were substantial.

3. Policy Responses by South Asian Countries and International Organizations

It is not easy for South Asian countries to strike a good balance between lockdowns and reopening the economy. Many had to ease lockdowns and cross border restrictions prematurely to rescue their economies, faltering growth and phenomenal loss of jobs given the level of informality of labor markets. To mitigate adverse impacts of the pandemic on the economy and people, by and large, there was a lot of commonality in the approaches and modalities of South Asian governments and central banks’ policy responses.

Pre-Covid, all South Asian economies except for Bhutan reported fiscal deficit, with India and Pakistan rising to over 7% of GDP in 2019. The fiscal impact of Covid-19 on India and Pakistan has been acute. The fiscal stimulus packages under the pandemic in this region were well below their economic requirements. The region stands out for a low tax/GDP ratio, which is coming under renewed stress with the onset of Covid-19 given the dwindling economic activities. For instance, in India, new fiscal spending commitments may come to about 1% of GDP, or roughly $20 per person, on top of its original budget for 2020 [2]. The consolidated defit is anticipated to reach 12% of GDP in FY2020-2021 as the revenue shortfalls will be sizeable, given both supply and demand contraction as evident from the doubling GDP growth contraction in the range of -8% relative to -4% in FY2020-2021. In Pakistan, the fiscal response package accounted for 1.2% of GDP, of which 0.6% was used to support vulnerable families and daily wagers, and 0.2% for the health sector. Bhutan established the National Resilience Fund, and deterred direct tax payments, sales tax and custom duties until June 2020, and waived rents for the tourist industry.

Due to the limited fiscal space faced by most South Asian countries, much of the mitigation burden has been shifted to central banks. Monetary stimulus has involved a combination of adjustments in policy rate (depending on the prevailing aggregate demand preconditions), liquidity support, concessional refinancing schemes, and relaxed debt payment requirements. For example, India has infused liquidity equivalent to 2.6% of GDP, allowed 3 months’ moratorium on loan payments, relaxed debt default norms on rated instruments, created facilities to help states with short term liquidity problems, and relaxed export repatriation limits. Sri Lanka lowered the Cash Reserve Ratio from 4% to 3%, enhanced Liquidity Facilities, and allowed banks to defer loan payments due in April until July without penalties.

In addressing the needs of sectors most badly hurt in the pandemic, most central banks allowed regulatory forbearance to promote credit flows to the retail sector, MSMEs, and to promote on lending to Non-Banking Financial Companies. India also set up Special Refinance Facilities of 0.2% of GDP to support SMEs, rural banks and housing financing companies. Sri Lanka strengthened Refinance Fund to provide subsidized funding to banks willing to lend to the priority sectors, including SMEs affected by COVID-19. Pakistan and Nepal also established Refinancing Schemes to incentivize financing support for SMEs.

Central bank reports are reassuring that policy transmission is working, though in some jurisdictions, uptake of schemes and refinancing is low, reinforcing the point that policy distortions are critical for financing to rejuvenate businesses. Central banks’ Financial Stability Reviews have allayed concerns regarding financial instability. However, vulnerabilities could grow as Non-Performing Loans have risen.

Under the pandemic, there have been significant and rapid responses from all multilateral financing institutions to support South Asia in safeguarding their economy and people from the economic and social impact of Covid-19. South Asian economies, except India, turned to seek IMF support. The International Monetary Fund (IMF) provided Rapid Credit Facilities (RCF) to countries, including Pakistan and Afghanistan. The IMF, World Bank, and ADB also provided funding and grant assistance to Bangladesh, Maldives, and Nepal, etc. At the same time, few regional economies availed for the G20 Debt Service Suspension Initiative to the tune of $3.3 Billion. It is notable that Pakistan borrowed over half of the regional emergency financing[3] and over 80% of the DSSI offered to the region.

Policy support from multilaterals helped in meeting the immediate spending needs. However, direct support for revamping and strengthening the ailing health system was confined to few countries. For the countries which received large scale financing assistance, the challenge had been to structure inflows during this crisis to augment fiscal resources without increasing debt vulnerabilities.

4. Economic Growth Forecast for South Asia under the Pandemic

Like other countries in the world, the South Asian region is likely to face severe consequences in the near and medium term, due to the uncertainties, penetration and impacts of the COVID-19 pandemic. According to the World Bank, South Asia’s regional GDP is expected to contract by 2.7% in 2020, compared to the optimistic forecast of 6.3% before the pandemic —the worst in 4 decades. And this is about 8.8% below the pre-pandemic growth. Some countries may fall into severe recessions. Under the pandemic, per capita income of South Asia countries will decline, and poverty and inequality trends will worsen.

These countries experienced sharp falls in domestic and external demand, and shocks to their global value chain. ADB analysis showed that, South Asia regions had severe problems in the poverty rate, trading and employment. Some countries will face stress in the financial sector as bank advances decline and defaults or delays in payment rise. A number of countries faced renewed fiscal stress, pressure on external accounts rose given the fall in exports, remittances and tourism receipts that strained foreign exchange reserves – a more serious concern for countries with low reserves. Central banks, however, contended that the financial sector is so far stable, but vulnerabilities have magnified.

Uncertainties regarding the pandemic’s duration compound economic uncertainty. However, countries and IMF/MDBs expect a recovery in 2021 with growth back to the positive territory, although lower than the pre-Covid level. However, this region, like the rest of the world, has a phenomenal opportunity to deploy measures to build back better through an emphasis on inclusiveness, sustainability, and climate-friendly development, while drawing lessons from the Covid19 pandemic.

Looking forward, South Asian Governments must navigate skillfully between virus containment and resumption of economic activity. Firstly, more strategization and financing are required to fight the pandemic on a timely basis. All countries in this region should strengthen the health and sanitary systems and adopt the guidance and protocols of the WHO, to enhance their ability to meet the Covid-19 and other regular medical needs. Multilateral Development Banks should continue to provide funding, to support improvement in the over-stretched health system in this region.

Secondly, there are legitimate calls for extension and expansion of the debt-relief support from the IMF and the G20. This will be critical for some of the South Asian economies that is borrowing to repay its liabilities, without which could further threaten already weak macroeconomic fundamentals, given the shrinking revenue growth and compressed ability to finance development expenditures. Countries on their part need to launch fundamental reforms to enhance productivity and innovation, to institutionalize social contract and safety nets. Specific measures may include the following: to promote basic income support schemes and emergency food supplies for people living in poverty, to target a gradual increase in public health spending to around 4% of GDP, to develop telemedicine, to exploit domestic resource base to generate the much-needed revenues, to strengthen the private sector policy environment to attract sustainable investments which generate jobs, serve exports markets and enhance economic efficiency.

[1] Latest World Bank, GEP report suggests that Covid-19 induced poverty will drag 42 million people below the $1.9 poverty line and 138 million below the $3.2 poverty line (or two thirds of global number).

[2] https://www.reuters.com/article/us-india-markets-analysis/indian-stocks-to-lag-rivals-as-stimulus-falls-short-idUSKCN24E23M

[3] IMF issued $1.386 billion Rapid Financing Instrument (RFI) to Pakistan to meet the urgent balance of payment and fiscal needs emerged from COVID-19 as it was difficult to recalibrate the Extended Fund Facility (EFF), while Afghanistan received $220 million RCF from the IMF to cover the fiscal gaps to finance pandemic spending and health and social mitigation measures.

Shamshad Akhtar is the Policy Sherpa of Boao Forum for Asia, with Liu Yan, Peng Liyang also work for Boao Forum for Asia