Can Robots Help Mitigate China’s Demographic Decline?

Can Robots Help Mitigate China’s Demographic Decline? (Yicai Global) March 2 -- With the recent census showing that China’s population shrank last year, demographic pressures seem to be on everyone’s mind.

A smaller population does not necessarily imply lower living standards. There are many ways to offset the effect of fewer workers on GDP per person.

First, people can be induced to work longer. Second, better education can make workers more productive. Third, “total factor productivity” can be raised by upgrading the country’s product mix and by finding efficiencies in the production processes.

A fourth way to increase output in the face of a declining labour force is to give the remaining workers better tools. Raising “labour productivity” in this way seems to be the motivation behind China’s “Robot+ Application Action Plan”. The Plan was jointly released earlier this year by the Ministry of Industry and Information Technology and 16 other ministries and departments.

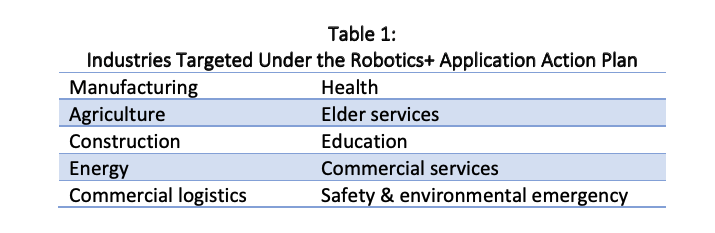

The Plan aims to use robotics as a way to promote high-quality economic and social development. It targets ten industries in which it wants to increase the use of robots (Table 1).

The use of robots in industrial production processes is already widespread in China. According to the International Federation of Robotics (IFR), China has been the world’s largest market for industrial robots since 2013.

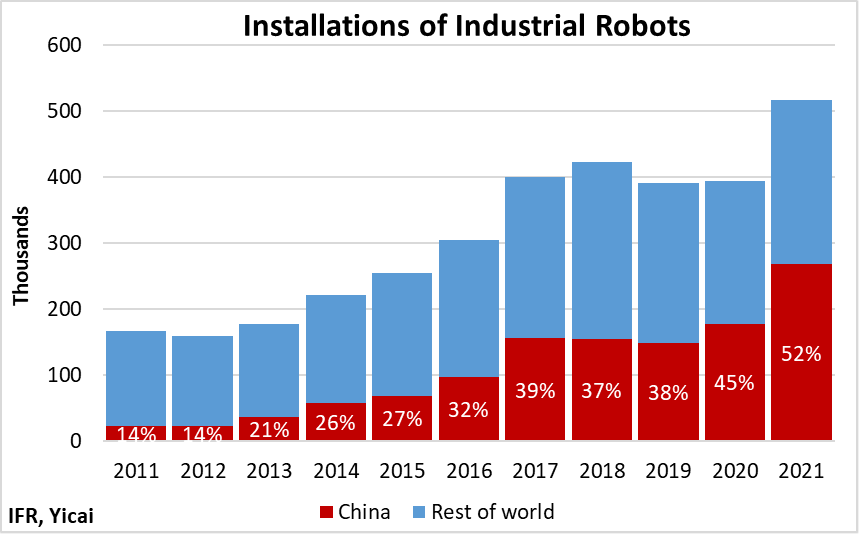

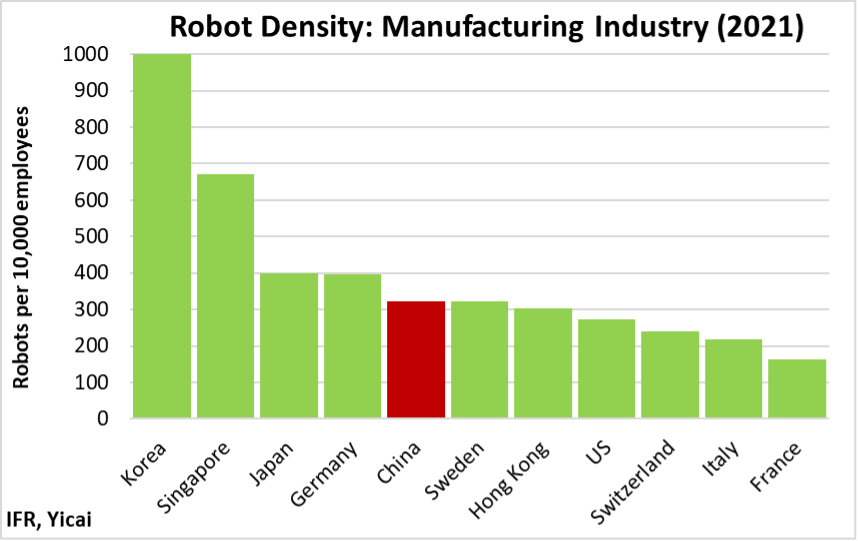

In 2021, China installed close to 270,000 industrial robots, more than half of all those put into place worldwide (Figure 1). The rest of the world had installed 270,000 industrial robots in 2018, a peak that it has been unable to surmount in subsequent years. Despite the economic dislocation caused by the pandemic, China’s installations continued to rise during 2020 and 2021. As a result, its share of global installations has increased sharply from the 38 percent it averaged between 2017 and 2019.

Figure 1

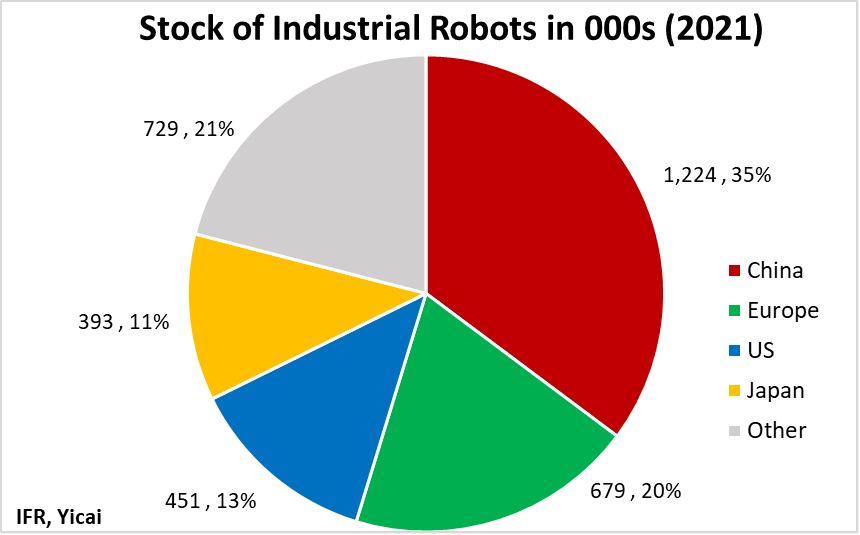

Since it has led the world in installations many years in a row, it is no surprise that the largest share of industrial robots can now be found in China. In fact, China’s 1.2 million industrial robots account for 35 percent of the global total – more than those in Europe and the US combined (Figure 2).

Figure 2

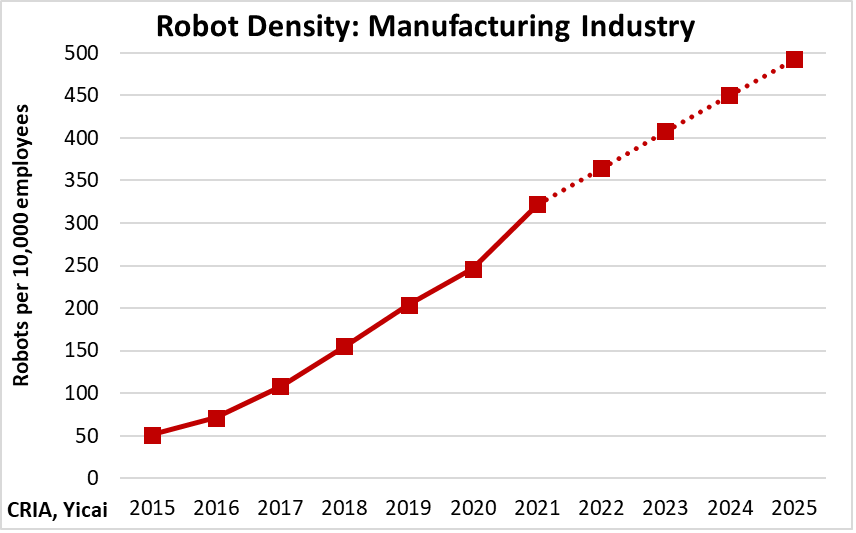

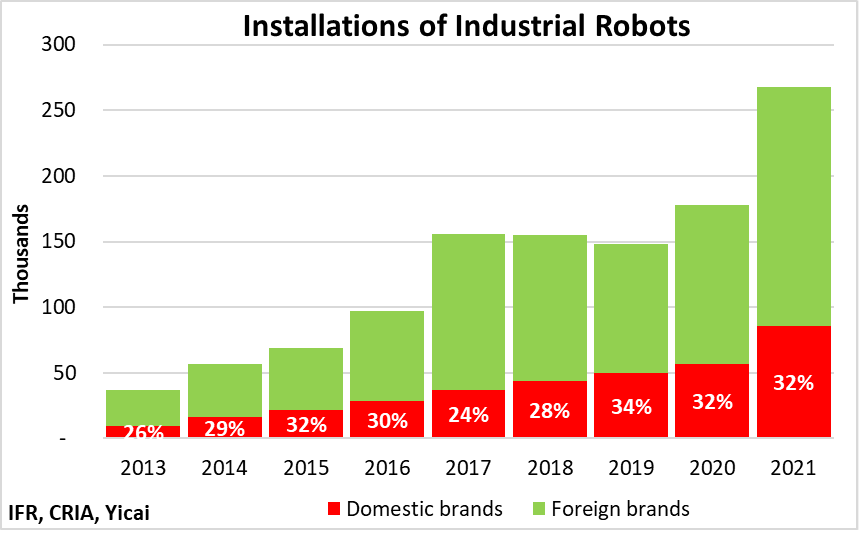

Data from the China Robot Industry Alliance (CRIA) show that China’s manufacturing sector has used robots more intensively over time. Its “robot density” – measured as industrial robots per 10,000 employees in the manufacturing sector – more than doubled between 2018 and 2021 (Figure 3). The Robot+ Application Action Plan envisages China’s robot density doubling again between 2020 and 2025.

Figure 3

In 2021, China’s robot density (322) surpassed that of the US (274) for the first time (Figure 4). Likely, China will soon overtake Japan and Germany, which are just under 400. The use of robotics in manufacturing is highest in Korea, which has a density of 1000. This suggests that there is room to attain China’s density target of 500 robots per 10,000 manufacturing sector employees.

Figure 4

Given its income level, China’s intensive use of robotics in manufacturing seems to defy economic logic.

Robots are costly pieces of machinery. As traded goods, their prices should be similar across countries. We would expect a manufacturing firm to use robots to produce if so doing would increase its profits by more than the robots’ purchase and installation costs. Looking around the world, the countries with the highest wages should be the ones that choose to substitute machines for people. But production workers’ wages in China are only about half those in the US and average wages in Korea and Japan are also well below American levels.

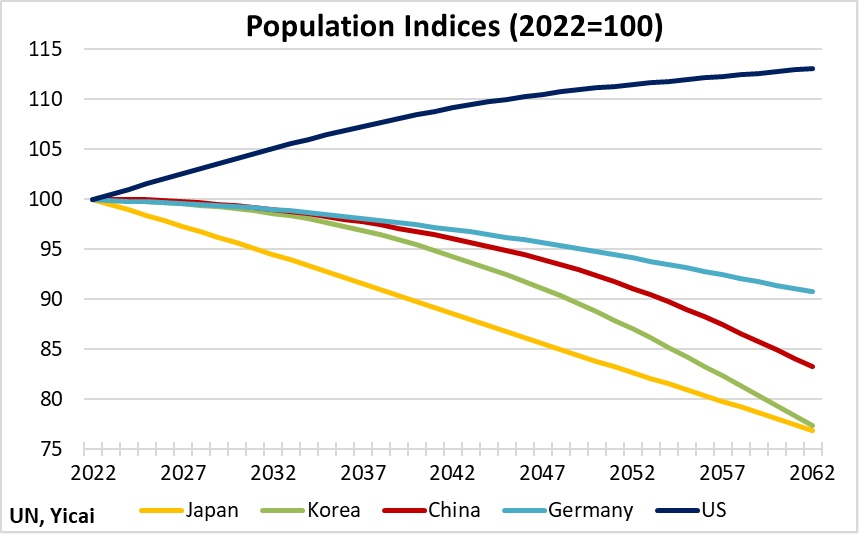

Demographics are likely driving the rapid adoption of robotics in Japan, Korea and China. These countries are expected to experience much sharper population declines than Germany, while the US’s population is expected to continue growing over the next 40 years (Figure 5).

Governments may be more sensitive to the impact of long-term demographic trends than businesses and China’s plan to encourage the adoption of robotics resembles similar programs in Japan and Korea.

Figure 5

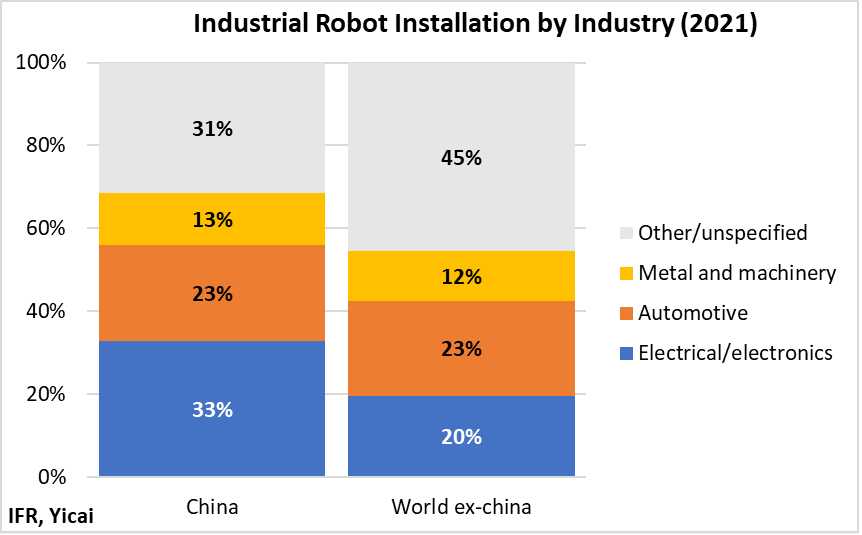

In 2021, the distribution of the robots installed in China across the manufacturing industries was broadly similar to those of other countries (Figure 6). Somewhat more robots were installed in China’s electrical/electronics industry, likely because it is relatively more important in the Chinese manufacturing sector. The automotive sector is a major user of robotics both in China and elsewhere.

Figure 6

Japan is the world’s biggest producer of industrial robots but the Chinese industry is growing rapidly. In 2021, China installed close to 90,000 robots made under domestic brands, almost double the amount installed in 2018. Domestic brands accounted for close to one-third of all industrial robots China installed in 2021 (Figure 7).

Figure 7

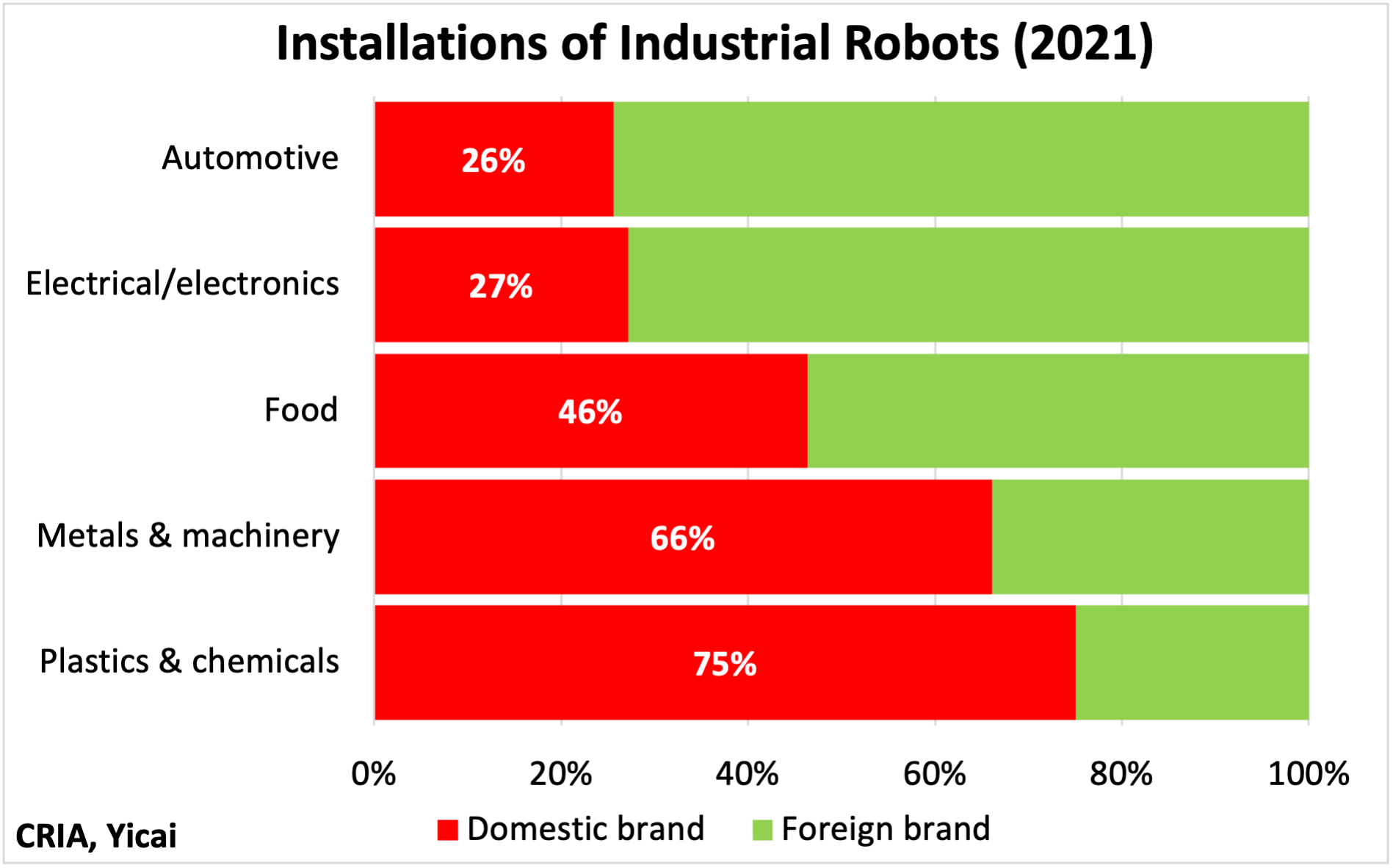

China’s domestic brands concentrate on producing robots for the plastics and chemicals and the metals and machinery industries where they accounted for three-quarters and two-thirds of the installations in 2021, respectively (Figure 8).

Figure 8

China’s robotics global leadership is also attracting new foreign investment.

ABB, a Swiss-Swedish multinational, recently opened a robotics mega factory in Shanghai. The CNY 1.1 billion ($150 million) production and research facility will manufacture next-generation robots. ABB predicts that the global robot market will grow from $80 billion today to $130 billion in 2025. The new Shanghai facility, one of three ABB Robotics factories worldwide, will support its customers in Asia.

The increased use of robotics may not offset the effects of demographic decline, but it should make the workforce more productive.

Cross-country research by economists at the Asian Development Bank shows that more intensive use of robotics leads to a fall in the demand for workers who perform routine manual tasks. However, automation also creates a demand for non-routine analytic jobs like programming, design and maintenance of high-tech equipment. The economists did not find a significant relation between robot adoption and overall employment growth. Nevertheless, moving workers from lower- to higher-value-added work is what ultimately increases living standards.