New Shanghai-Backed VC Firm to Put USD2.8 Billion Into Science, Tech Innovation Projects

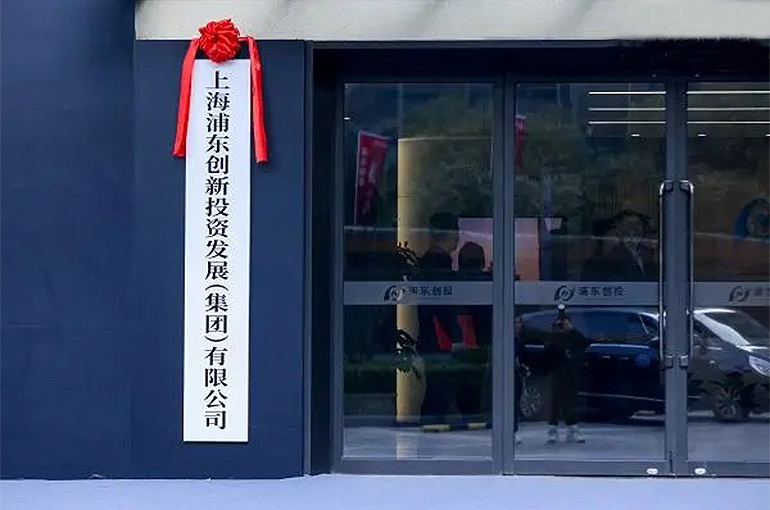

New Shanghai-Backed VC Firm to Put USD2.8 Billion Into Science, Tech Innovation Projects(Yicai) Jan. 5 -- Shanghai Pudong Innovation Investment Group, a state-owned venture capital firm that began business yesterday, plans to invest CNY20 billion (USD2.8 billion) in science and technology innovation projects over the coming three years and attract CNY200 billion (USD28.1 billion) in funding by 2027.

Pudong Innovation, with a registered capital of CNY10 billion, has raised CNY22.2 billion and made direct investments in 18 projects during its setup phase. It has established four funds of funds: Guofang with CNY7.1 billion (USD997.5 million), Guotai Junan with CNY4.1 billion, Haitong with CNY4 billion, and Haiwang with CNY7 billion.

Pudong Innovation, which is funded by the State-owned Assets Supervision and Administration Commission of Shanghai Pudong New Area, has also formed a science and technology innovation project database. The database includes the equity financing needs of more than 1,200 early-stage projects, which seek to raise about CNY12.1 billion.

“Return on investment is one of our focuses, but not the only one,” said Li Yumin, director of the the Pudong state assets manager’s planning and development department. During any downturn in the venture capital market, Pudong Innovation would play a counter-cyclical investment role as a state-owned VC group, Li added.

According to industry practice, the investment assessment period is generally five to seven years, but Pudong Innovation has adjusted the period for some fund investments to 10 years, adapting to the long return cycles of certain industrial projects, including integrated circuits, China News Service reported yesterday.

Editor: Martin Kadiev