Germany's Heraeus, Other Foreign Firms Stay Upbeat on China’s Electronics, Chip Markets

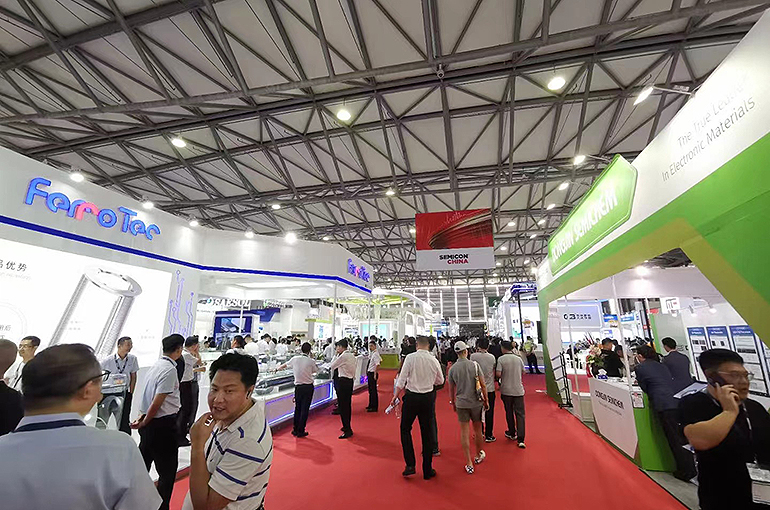

Germany's Heraeus, Other Foreign Firms Stay Upbeat on China’s Electronics, Chip Markets(Yicai Global) June 30 -- Germany’s Heraeus and many other overseas tech companies remain optimistic about China’s electronics and semiconductor markets, executives who are currently in Shanghai attending some of the biggest exhibitions in the industry told Yicai Global.

“Our business is growing fastest in the semiconductor and electronics fields among all sectors and China is Heraeus’ most important market worldwide,” Ai Zhouping, president of Heraeus’ China arm, told Yicai Global at Semicon China, the world’s largest semiconductor event.

“The exhibition is more popular than we expected, an indication that China’s chip market is booming,” Ai said.

Semicon China has returned this year bigger and better than ever after being canceled last year due to Covid-19. With an exhibition area covering 90,000 square meters, it has lured over 1,100 exhibitors, boasts more than 4,200 booths and will hold more than 20 meetings and events.

FPD China 2023, an expo that focuses on the display and touch screen sectors, is also underway in the metropolis.

Demand in China’s chip market has surged almost 50 percent from before the pandemic, another executive from a foreign semiconductor company exhibiting at the event said.

Industries as well as applications that focus on semiconductors are constantly expanding, the person said. China is also investing more in R&D, which is accelerating home-grown tech, and has big demand for advanced international technologies and solutions, he added.

The semiconductor materials field is showing signs of a mild recovery this quarter and will hopefully return to growth after slumping in the fourth quarter last year and the first quarter this year, said Shen Fangzhong, vice president of China sales at Hanau-based Heraeus.

The actual speed of recovery will depend on demand, Shen said. “We perceive current demand to still be weak, but we are optimistic about the medium and long term.”

Mild Recovery

Global chip sales tumbled 21.6 percent in April from the same time last year, but edged up 0.3 percent from the previous month, marking the second consecutive month of month-on-month growth, according to data released by World Semiconductor Trade Statistics earlier in June.

The growth was mainly boosted by China where chip sales climbed 2.9 percent from March, and in Japan they edged up 0.9 percent. However, monthly sales dropped in Europe and the US.

Demand for chips in the electric car and renewable energy fields will stay strong and the growth of generative AI will spur demand for logic chips, the WSTS report said. Global semiconductor sales are expected to jump 11.8 percent next year to USD576 billion, beating last year’s record high.

Investment Cools

Many semiconductor industrial chains, which were originally based in China, are going through changes as the landscape of the global market shifts, and this has affected foreign investment in China.

Foreign firms’ previous strategy of “Locating in China, Selling to the World” is now weakening and more overseas investment is going towards localized upgrading and providing more R&D and services in China, so as to better satisfy the local market, Ai said.

“Our China team is constantly expanding, however, against the backdrop of growing uncertainties such as trade frictions, foreign companies will tend to be more cautious about investment in China and will take longer to make decisions, the executive from the foreign exhibitor said.

Editors: Shi Yi, Kim Taylor